How Brexit could impact Virginia trade

While an ocean separates Virginia and the United Kingdom, the 21st century world is a pretty small place for things and stuff. The UK vote to leave the European Union has economists widely predicting some pretty serious economic turmoil in the future. What could it mean for Virginia though?

The UK is one of Virginia’s biggest trading partners

According to the US Census Bureau’s Origin of Movement Series, the United Kingdom was the 4th largest importer of goods from Virginia in 2015. The US $1.05 billion worth of material exported to the UK made up about 5.8% of the commonwealth’s $18.1 billion in exports.

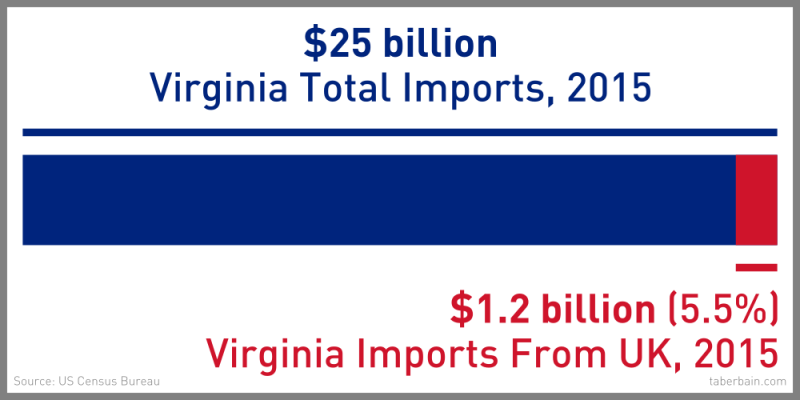

We don’t just sell to the UK either. Virginia imported about $1.2 billion worth of goods from in the same year, or about 4.8% of the state’s total imports.

A word of caution about these figures: ”Origin of Movement” data is designed to capture the origin of transportation for foreign-bound goods by US companies, not their point of manufacture. This figure includes products that weren’t made in Virginia, but were first packaged for transit out of the United States here, and fails to include any Virginia products that were shipped to other states before leaving the country. It certainly doesn’t match up precisely with the actual volume of goods moving out of or into the country via Virginia, a state with large and sophisticated shipping facilities and advanced logistics operations.

Even with those caveats on the actual numbers, it’s clear that the United Kingdom is one of Virginia’s most important trading partners. How could their leaving the European Union affect that?

A weaker pound means the United Kingdom can’t afford our stuff

Even before any procedural steps have been taken to physically part from the EU, the pound has massively depreciated against the dollar in the expectation that the UK could face a long, difficult road to rebuild favorable trade agreements with continental Europe.

A pound that’s weak against the dollar puts our products at a comparative disadvantage to UK customers. While sterling remains in the doldrums, importers in the United Kingdom will be searching for other suitable sources of goods that have become too pricey to purchase from the US.

We could get some bargains, but don’t count on many

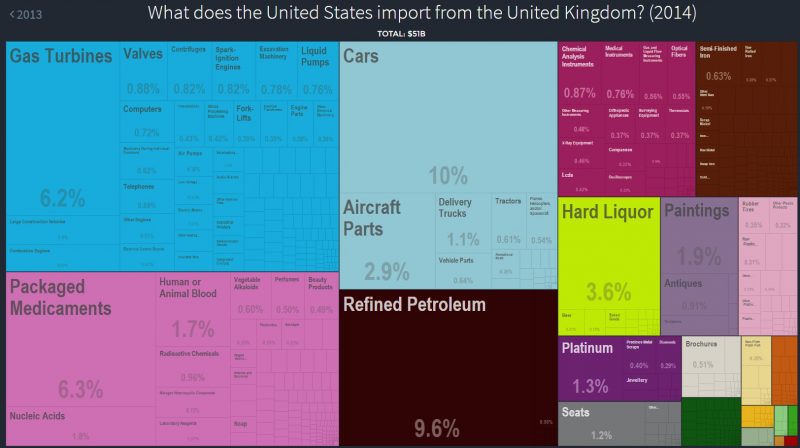

Of course, the inverse – that a strong dollar could make some things we import from the UK more affordable – is also true. Unfortunately, much of what the US as a whole imports from the UK (Data: World Bank) is very specialized products like industrial machinery and medicines, which are unlikely to be repriced at retail, and refined petroleum, which is typically sold in dollar-denominated funds anyway.

<figcaption id="caption-attachment-19" class="wp-caption-text">By the way, click through to this thing, this site is amazing</figcaption></figure>

<figcaption id="caption-attachment-19" class="wp-caption-text">By the way, click through to this thing, this site is amazing</figcaption></figure>

So is Virginia going to be OK?

Yeah, things are gonna be fine! Our economic fortunes are more closely tied to Old Blighty than they are to the rest of Europe, but while Virginia should be ready for some ripple effects from any trouble in their domestic market, direct international exports from the commonwealth make up a comparatively small percentage of our $480 billion gross state product. That’s because we happen to remain in our own version of the EU free trade area: the United States domestic market.

What Virginia firms sell to and buy from the UK matters, but the direct aggregate impact should be relatively small.